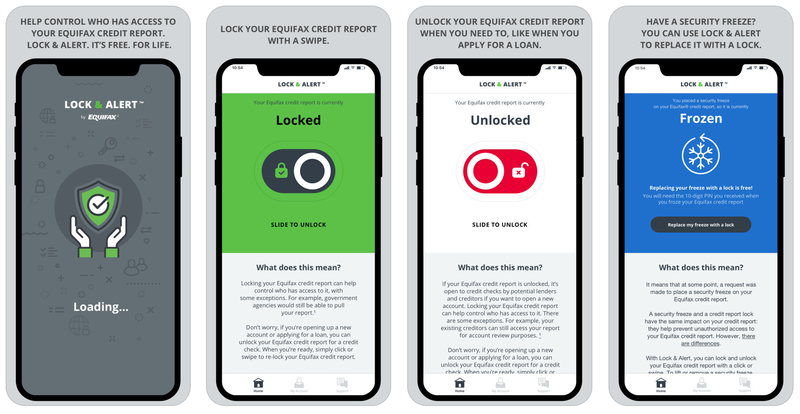

When we swiped a finger across that icon, a big green "Locked" appeared several seconds later. It opened to a single screen with a big red "Unlocked" on it. So CR downloaded the mobile app and scrutinized the fine print to see how Lock & Alert stacks up. But locking every door and window to your financial house is essential to safeguarding your privacy against crooks, and every protection tool should be considered. Currently, only 12 percent of identity theft involves new-account fraud. The Equifax data breach, revealed in September 2017, compromised the personal information of more than 145 million Americans.

EQUIFAX SECURITY FREEZE FREE

Innovis, a fourth, lesser-known credit bureau, offers credit freezes free of charge but doesn't offer a "lock" service, according to Mike Catello, its vice president of operations. TransUnion has offered a free standalone lock for consumers since 2016, but only in exchange for an agreement to receive targeted marketing offers. "We need to strike that balance.But Lock & Alert promises to be faster and easier than a freeze, and free for life.Įxperian allows consumers to "lock" their credit as part of its credit-monitoring services for $10 to $25 a month. "We want to make it is as simple as possible to access that freeze, but we want to protect you at the same time," Experian's Griffin said.

If the credit bureaus cannot sufficiently verify your identity based on the information you've provided, you may need to mail in copies of your driver's license, utility bills or other supporting documentation to validate your identity and execute a freeze. Step 3: Jot down your PIN number, as you will need it to change the status of your freeze, like when you want to “thaw” or unfreeze it to get a loan for a new car or apply for a mortgage. (Or if you already have a freeze in place, select whether you want to temporarily “unfreeze” it or remove the freeze permanently Step 2: Select the security freeze option. You also may need to answer a few questions about your background, including loans you've taken out, credit cards you hold or previous addresses to confirm your identity. (Note: You can also submit a credit freeze request via phone or in writing.) You may be asked to provide a previous address if you have lived at your current one for less than two years. Step 1: Go to the credit bureau websites and locate the “security freeze” link.įor Equifax: For Experian: For TransUnion: Type in your name, address, social security number and date of birth. Placing a freeze should be fast and relatively easy, although you will have to sign up for separate ones at each of the three credit bureaus.

EQUIFAX SECURITY FREEZE HOW TO

More: McDonald's gives students $25,000 after their fake ad went unnoticed in epic prank How to "freeze" your credit report More: In debt and out of options, thousands of dairy farmers turn to GoFundMe for bailout Less severe than a freeze, fraud alerts tell lenders that your personal data may have been compromised and to take extra steps to verify your identity before approving new credit.Įxisting alerts on Experian reports will automatically be extended, according to Rod Griffin, director of consumer education and advocacy at Experian. The law also extends how long a fraud alert remains on your credit reports from 90 days to one year. The new law comes more than a year after Equifax disclosed a major data breach that exposed the personal information of 148 million Americans and prompted lawmakers to rethink identity security. Before, it cost consumers in almost half the states $3 to $12 per bureau to freeze or unfreeze their credit reports.Ī freeze prevents lenders from pulling a person's credit report – a key part of the approval process for a credit card or loan – essentially preventing fraudsters from opening a new account in that person's name or the name of someone in their family.

21, a new federal law allows people to freeze and unfreeze their credit at the three major credit bureaus without being charged. One of the best ways to protect yourself from identity theft is now free.Īs of Sept.

0 kommentar(er)

0 kommentar(er)